Excitement About Lighthouse Wealth Management, A Division Of Ia Private Wealth

Wiki Article

5 Simple Techniques For Lighthouse Wealth Management, A Division Of Ia Private Wealth

We motivate you to take this very first action find out about the benefits of working with an economic expert and see what a difference it makes to have a partner on your financial trip. A monetary expert can bring you closer to the future you see for on your own in many ways from creating tailored savings strategies for all your short- and long-term goals, to choosing the ideal financial investment products for you, working through estate considerations and setting up insurance coverage defense for you and your liked ones.

Several question what a monetary advisor does. A financial expert is often liable for more than just executing professions in the market on behalf of their clients.

With each other, you and your consultant will certainly cover lots of topics, consisting of the amount of money you need to save, the kinds of accounts you need, the kinds of insurance you must have (including lasting care, term life, impairment, and so on), and estate and tax planning.

Listed below, discover a checklist of the most typical services provided by monetary advisors.: An economic advisor uses advice on investments that fit your design, goals, and threat tolerance, developing and adjusting spending strategy as needed.: A monetary consultant produces strategies to assist you pay your financial obligation and prevent debt in the future.: A monetary expert offers ideas and approaches to create budgets that assist you satisfy your objectives in the brief and the lengthy term.: Part of a budgeting strategy may include methods that aid you pay for higher education.: Also, a monetary consultant develops a conserving plan crafted to your details demands as you head right into retirement.: An economic advisor helps you determine the individuals or organizations you desire to receive your legacy after you die and creates a plan to perform your wishes.: A financial expert provides you with the best lasting services and insurance options that fit your budget.: When it pertains to taxes, a monetary advisor might assist you prepare tax obligation returns, take full advantage of tax deductions so you obtain the most out of the system, schedule tax-loss harvesting protection sales, ensure the most effective usage of the capital gains tax obligation rates, or plan to minimize tax obligations in retired life.

How Lighthouse Wealth Management, A Division Of Ia Private Wealth can Save You Time, Stress, and Money.

It is essential for you, as the customer, to comprehend what your organizer advises and why. You must not adhere to an expert's suggestions unquestioningly; it's your cash, and you must comprehend just how it's being deployed. Keep a close eye on the charges you are payingboth to your expert and for any type of funds acquired for you.

The average base salary of a monetary consultant, according to. Anyone can function with an economic advisor at any age and at any stage of life. You don't need to have a high web well worth; you just have to locate a consultant suited to your situation. The choice to get professional assist with your cash is a highly personal one, but at any time you're really feeling overwhelmed, puzzled, stressed, or terrified by your financial scenario may be a great time to seek a monetary consultant.

It's additionally fine to come close to a monetary consultant when you're feeling financially protected yet you want a person to guarantee that you get on the appropriate track. An expert can suggest feasible enhancements to your strategy that may aid you attain your objectives more successfully. https://pxhere.com/en/photographer-me/4121010. Lastly, if you don't have the time or passion to handle your funds, that's an additional excellent factor to employ a monetary consultant.

Right here are some more certain ones. Because we stay in a globe of rising cost of living, any kind of cash you maintain in money or in a low-interest account declines in worth annually. Investing is the only way to make your money expand, and unless you have an incredibly high earnings, investing is the only way the majority of people will ever before have sufficient money to retire.

The Facts About Lighthouse Wealth Management, A Division Of Ia Private Wealth Revealed

But, on the whole, investing need to enhance your internet worth significantly. If it's refraining from doing that, working with a financial expert can assist you figure out what you're doing wrong and right your training course prior to it's too late (https://hearthis.at/carlos-pryce/set/lighthouse-wealth-management-a-division-of-ia-private-wealth/). A monetary expert can additionally help you placed together an estate strategy to ensure your assets are managed according to your wishes after you die

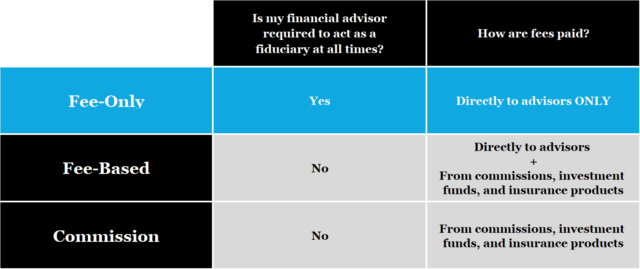

Without a doubt, a fee-only economic advisor might have the ability to use a much view publisher site less biased viewpoint than an insurance policy representative can. Follow these simple action in order to choose the ideal economic consultant that supplies strategies and services that fit your goals and needs. Talk to a couple of different consultants and compare their services, design, and fees.

You want a consultant that is well mindful of your risk resistance and urges you to take sensible choices. A policy recommended by the Division of Labor (DOL) would certainly have required all monetary specialists who collaborate with retirement or give retirement recommendations to give advice that is in the client's best interest (the fiduciary standard), instead of merely suitable for the client (the viability requirement).

Yet in the about three-year period between Head of state Obama's proposal of the rule and its ultimate death, the media shed extra light than it had formerly on the various ways economic consultants function, just how they bill for their services and exactly how the viability requirement could be less useful to customers than the fiduciary requirement - ia wealth management.

The Best Strategy To Use For Lighthouse Wealth Management, A Division Of Ia Private Wealth

Others, such as licensed economic organizers(CFPs), already abided by this requirement. https://lighthousewm.weebly.com/. However also under the DOL policy, the fiduciary requirement would certainly not have used to non-retirement suggestions. Under the suitability requirement, economic experts commonly work with payment for the items they offer to clients. This means the customer might never receive a costs from the economic expert.

Report this wiki page